The Rufus M. Rose House presents an opportunity to own a landmark on Atlanta’s most prestigious street. Powerful preservation tax incentives make its redevelopment feasible and will result in a unique, highly visible commercial property. Schedule your showing today!

Historic Atlanta, Inc. will donate 5 hours of consultation to assist in the preparation of application materials for historic tax credit programs for this property. Contact us to learn more.

Property Description

The 1901 Rufus M. Rose House was designed by Atlanta architect E.C. Seiz and is one of only two Victorian mansions remaining on Atlanta’s renowned Peachtree Street. It is an excellent example of Queen Anne style architecture, and, as a townhouse built for a wealthy family, it is a true rarity for Atlanta. The property retains nearly all of its original interior and exterior features, clearly conveying its cultural and architectural significance.

As stated by the Atlanta Urban Design Commission, the Rose House “conveys a sense of residential Peachtree at a time when streetcars, not automobiles, determined the patterns of residential development and its importance as such cannot be overstated.”

Historic Designations

The Rufus M. Rose House was listed in the National Register of Historic Places in 1977 and designated as a Landmark Building by the City of Atlanta in 1989. Its status as a locally designated landmark ensures that the building cannot be demolished or have its character-defining features removed (more info). All proposed changes must be reviewed and approved by the Atlanta Urban Design Commission.

Rehabilitation Incentives

More importantly, because the house is listed in the National Register of Historic Places, it is eligible for state and federal preservation tax incentives for rehabilitation:

- The Federal Rehabilitation Investment Tax Credit (RITC) is a federal income tax credit equal to 20 percent of qualified rehabilitation expenses, available for income-producing properties, with no cap on expenses.

- The Georgia State Income Tax Credit Program for Rehabilitated Historic Property a state income tax credit equaling 25 percent of qualified rehabilitation expenses capped at $100,000 for a personal residence, and $300,000, $5 million or $10 million for all other properties.

- The Georgia Preferential Property Tax Assessment Program for Rehabilitated Historic Property allows eligible participants to apply for an 8 1/2 -year property tax assessment freeze at the pre-improved value.

- A charitable contribution donation can be taken in the form of a conservation easement, and enables the property owner to receive a one-time tax deduction. A conservation easement ensures the preservation of a historic building’s façade in perpetuity.

Historic tax credits can be captured by the property owner over a two-year period (federal) and a seven-year period (state), or can be syndicated for additional equity capital that can be utilized for long-term financing of the rehabilitation project. Other examples of rehabilitation projects in Atlanta that have utilized historic tax credits include Ponce City Market, Hotel Clermont, and Manuel’s Tavern.

A Conditions Assessment Report conducted by Surber Barber Choate & Hertlein Architects in 2016 describes the Rufus M. Rose House as a building that is in need of substantial repair but is fundamentally structurally sound. The report estimated the total cost of rehabilitation at between $1.3 million and $2.2 million, depending on the extent of the work performed. Therefore, a buyer undertaking a rehabilitation project with historic tax credits could expect to receive up to approximately $400,000 in federal tax credits and approximately $500,000 in state tax credits. Additionally, the assessed value of the property could be frozen at the pre-improved value for 8 1/2 years.

Transfer of Development Rights (TDR’s) are also available for this property. Properties that are designated as a Landmark Building or Site can transfer unused development rights to a property that can buy those rights and increase the density. The Rufus M. Rose House has approximately 235,000 square feet of unused residential and non-residential space. The current market value is $10-15 per square feet creating a revenue of approximately $2 million dollars.

History

The 1901 Rufus M. Rose House was designed by Atlanta architect E.C. Seiz for the founder of the R. M. Rose Co. Distillery in Vinings. The house is one of only four historic mansions remaining on Atlanta’s renowned Peachtree Street, is an excellent example of Queen Anne style architecture, and, as a townhouse built for a wealthy family, it is a true rarity for Atlanta. The property retains nearly all of its original interior and exterior features, allowing its cultural and architectural significance to be conveyed clearly.

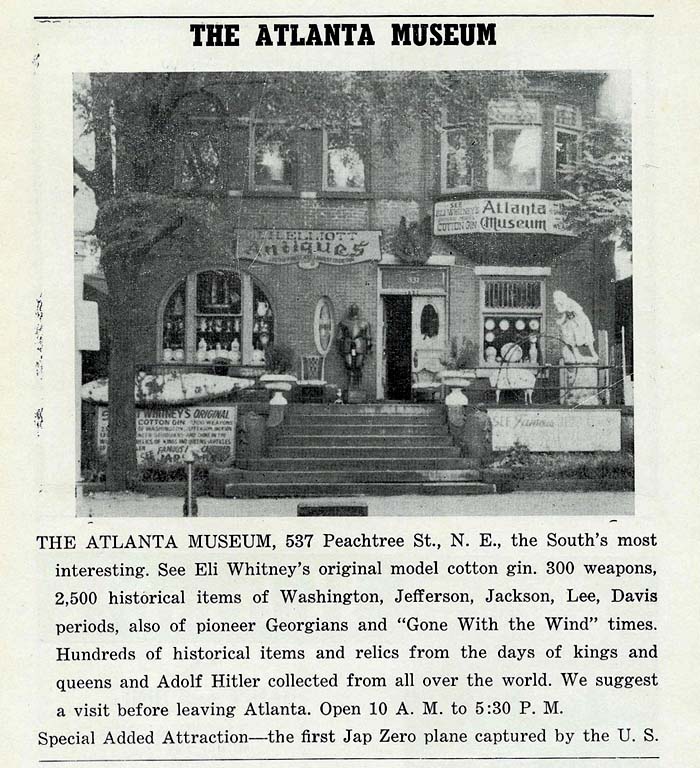

Many remember the Rose House as the home of J.H. Elliot’s Antiques (since 1945) and Mr. Elliot’s eclectic “Atlanta Museum.” The museum was in operation until 1993, when its doors finally closed except for a temporary re-opening during the 1996 Olympics.

Photo from the c.1903 publication Arts of Atlanta, via Atlanta Time Machine.

1952 ad for The Atlanta Museum.

Image from Atlanta Time Machine.

___

Exclusively Listed By

REALTOR

404-376-1538